- Payouts Club by Dots

- Posts

- 🌐 How to Optimize 1099 Filing For The End Of The Year

🌐 How to Optimize 1099 Filing For The End Of The Year

Issue #5, November 28, 2023

Welcome to the Payouts Club! 💸

Payouts Club is a bi-weekly newsletter about everything payout-related featuring guides, written content, interviews with founders, case studies, and collective thoughts from fintech leaders and creators.

Each week we’ll cover the most relevant topics from for anyone who works with payouts on the daily which includes:

Companies paying out contractors like freelancers and gig workers

Contracted freelancers, creatives, gig workers

Here’s this week’s edition:

🌐 How to Optimize 1099 Filing For The End Of The Year

Working with an international contractor can be one of the easiest ways to With the end of the year coming up, tax season is rapidly approaching. Collecting 1099s, necessary identifying information, and ensuring compliance can be a daunting task, but it doesn’t have to be.

Knowing the right forms, tools, and dates for filing tax forms for independent contractors can ensure a smooth year end process.

There are different requirements for domestic and international contractors, and today’s newsletter will provide you with various resources to better prepare and optimize your 2023 taxes.

In today’s newsletter, we’ll explore:

💸 How to streamline your payment infrastructure for EOY tax filing

📊 What information needs to be collected for 1099 filing

🗒️ W-8 BENs and tax filing for international contractors

✅ Tips for avoiding an IRS audit

📚 Gentle Guides:

Onboarding requires proper compliance, understanding of 1099 contractors, and most importantly, should be as simple and straightforward as possible to reduce drop-off.

4 things you need to collect from contractors for success 1099 filing:

Their full legal name

Their address

The total amount paid to them during current tax year

Their taxpayer ID number (SSN or EIN)

💡 Pro-tip: Use a payouts API that automates information collection and tax filing for you if you haven’t already. :)

Deadline to keep in mind: January 31, 2023 to file both Copy A & Copy B of Form 1099-NEC

Can be submitted electronically through the IRS FIRE system

You will need to prepare several tax documents if you’re a company that works with contractors. Here are the important tax forms to know:1099-NEC, 1099-K, W-9, W-8 BEN. Having all of these documents will help you remain compliant and minimize your risk of penalty.

In this guide, we break down what a W-8BEN Form is, why it’s used, and who needs to fill it out. With a W-8BEN Form, you can confirm that the employee is not a US citizen, confirm they’re the owner of the income, and allow them to claim a reduced tax rate if applicable.

🔎 Fresh Finds: Contractor Tax Filing Edition

Our weekly pick for the best posts, articles, and other content from the community about end of year tax filing for domestic and foreign contractors.

1099-K needs to be filed if contractors received payment via a third party processor like PayPal, Venmo, and Amazon.

By: TurboTax

Bryce breaks down the most common 1099 form for independent contractors: 1099-NEC and a simple breakdown of how to fill out and submit Copy A and Copy B.

By: Bryce Warnes/Bench

Mistakes in 1099 filing can lead to high fees and time-consuming IRS audits. Kathryn points out frequent mistakes made when filing 1099s and 4 tips for avoiding an audit.

By: Kathryn Pomroy/Quickbooks

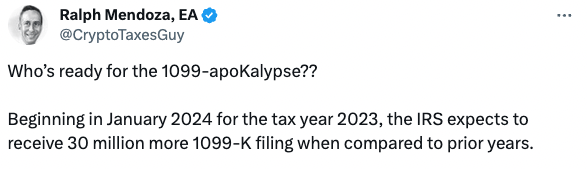

💬 Talks & Tweets:

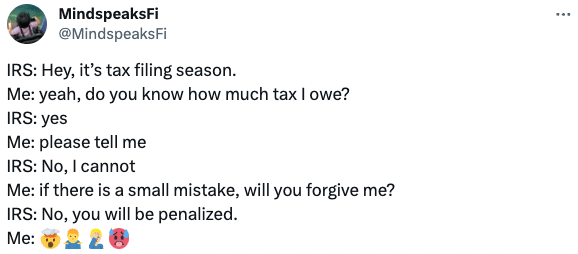

Thank goodness you’re prepared now after reading this edition of Payouts Club, right?

Yep, that’s how it goes…so we recommend automating your filing if you haven’t already!

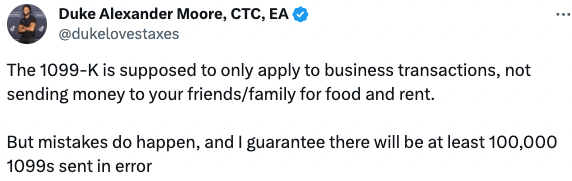

This is a common myth I’ve heard many questions about. Thanks for clarifying Duke.

TL;DR: Tax filing season is rapidly approaching! Know the difference between 1099-Ks, 1099-NECs, and W-8 BENs and go over common mistakes before submitting. And if you haven’t already, automate your info collection and tax filing for next year with a payouts API like Dots. :) Drop me a message here if you have any topics you’d like me to cover in the next edition or if you have any questions about 1099 automation.

That’s all folks.

Looking to stay up-to-date with everything payouts and connect with other payouts people just like yourself? Tune into Payouts Club for bi-weekly newsletters in your inbox.

Update your email preferences or unsubscribe