- Payouts Club by Dots

- Posts

- ✨ How to Improve KYC & Onboarding Processes For The New Year

✨ How to Improve KYC & Onboarding Processes For The New Year

Issue #7, January 19, 2024

Welcome to the Payouts Club! 💸

Payouts Club is a bi-weekly newsletter about everything payout-related featuring guides, written content, interviews with founders, case studies, and collective thoughts from fintech leaders and creators.

Each week we’ll cover the most relevant topics from for anyone who works with payouts on the daily which includes:

Companies paying out contractors like freelancers and gig workers

Contracted freelancers, creatives, gig workers

Here’s this week’s edition:

✨ How to Improve KYC & Onboarding Processes For The New Year

Last week, FinCEN reported that 1.6 billion reports received in 2021 were regarding identity - equal to $212 billion in fraudulent scammer activity (link here). Scammers exploit identity data through various methods including impersonation and exploitation of weak KYC (Know Your Customer) processes.

KYC has been viewed as a simple conversion issue for too long. KYC, which currently focuses on one-time ID verification during onboarding, isn’t enough.

Today’s newsletter will provide you with various resources to build upon and understand the KYC process - let’s dive in.

In today’s newsletter, we’ll explore:

✅ How to improve your KYC process

📊 What information needs to be collected for onboarding

💸 Common online fraud schemes and how to reduce risk

📚 Gentle Guides:

KYC checks are integral to privacy and must be done regularly. The regulations and laws can also vary by country, making compliance especially complex.

W-9 form verifies the contractor's identity and eligibility to work for your company as a part of KYC. If you’re working with an international contractor, you’ll need a W-8BEN instead.

In this guide, we share common online fraud schemes to look out for in addition to identity-related scams like phishing. We also share a list of warning signs to watch out for such as rapid transactions, multiple addresses, and multiple credit cards.

🔎 Fresh Finds: Global Contractors Edition

Our weekly pick for the best posts, articles, and other content from the community about KYC and onboarding.

While KYC is only legally required for financial institutions and related companies, KYC can greatly benefit all businesses in any industry.

By: Persona

This LinkedIn post breaks down 6 best practices for KYC including a risk-based approach, robust record-keeping, and employee training.

By: Clear View Systems

Meghna shares 5 common KYC frauds and the common tactics employed by fraudsters to stay aware of.

By: Meghna Maiti

💬 Talks & Tweets:

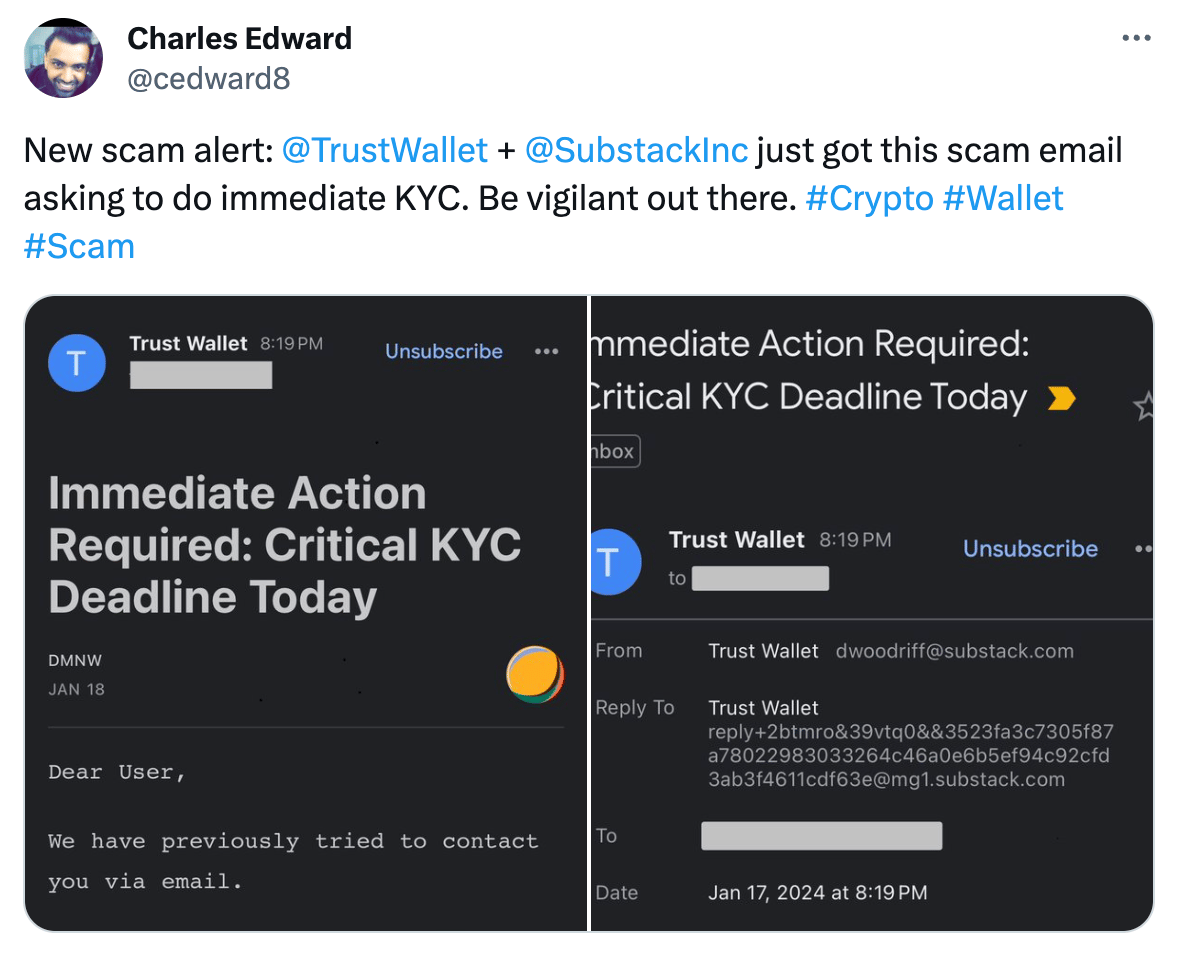

This tweet was posted yesterday. Scammers aren’t slowing down anytime soon, so you better get prepared.

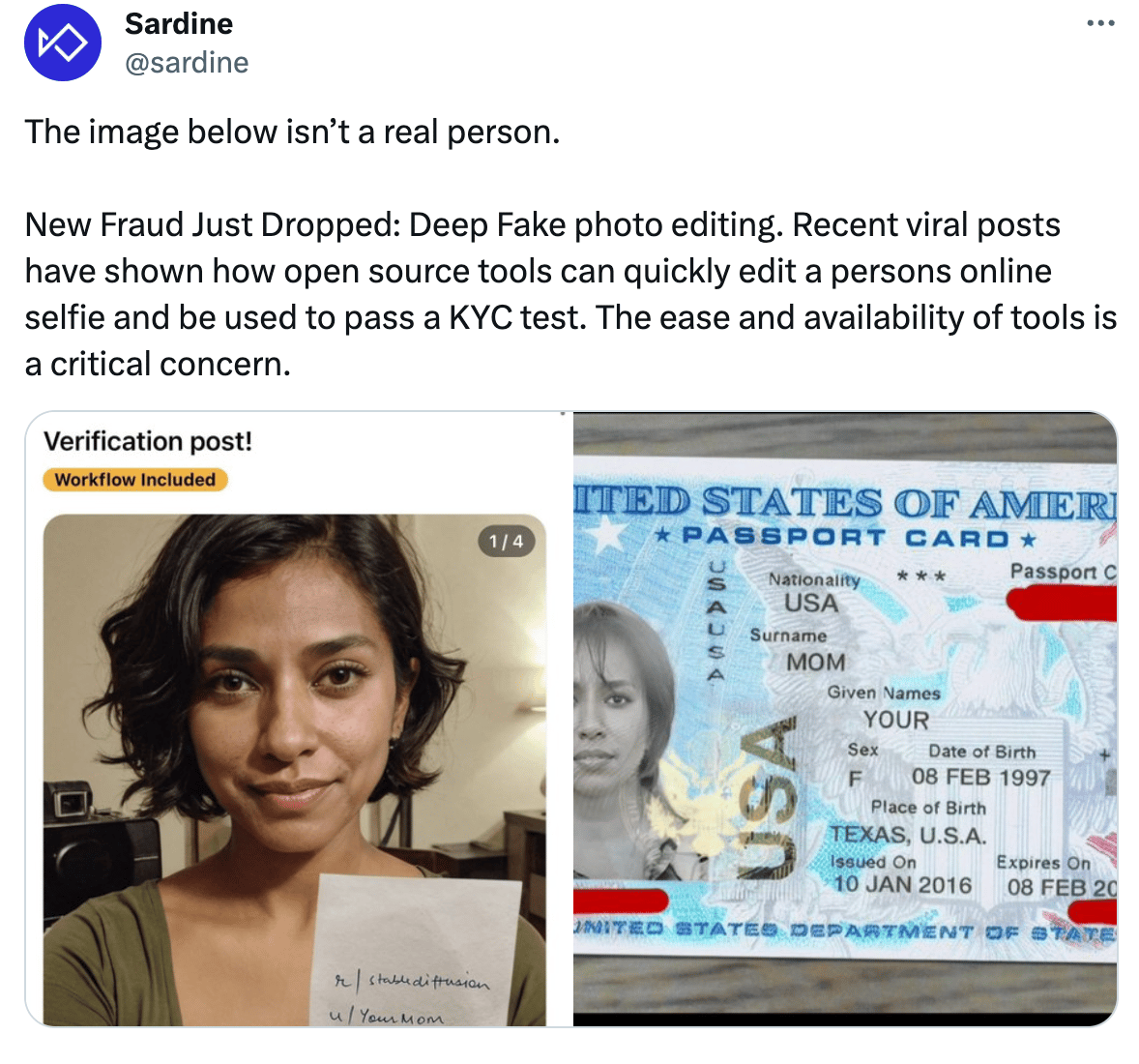

AI-related fraud is on the rise, and that means fake IDs that exploit weak KYC verification processes.

Don’t let a small mistake become a fraud case!

TL;DR: $212 billion in fraudulent scammer activity was detected in 2021. KYC isn’t just a conversion issue during onboarding, it’s an integral part of a business’s long-term success, and we’ve shared many resources to improve your KYC process. Drop me a message here if you have any topics you’d like me to cover in the next edition or if you’re looking for an API that takes care of KYC for you :)

That’s all folks.

Looking to stay up-to-date with everything payouts and connect with other payouts people just like yourself? Stay subscribed to Payouts Club for bi-weekly newsletters in your inbox.